All about Property Surveys

All about Property Surveys

While an article about property surveys isn’t overly inspiring, there are still many misconceptions out there when it comes to surveys. In fact, many first-time buyers don’t even know they should book a survey when buying a home. This is why we thought it was important to help clear up a few points and give our advice on everything about property surveys.

Read more…

Lender Surveys

When you buy a property, your mortgage lender will generally require a valuation of the property. They need this to ensure the amount they loan to you is secure and can be easily recouped if you were to default on any of the repayments. This is known as a standard valuation report. You can take this and upgrade it to a homebuyer’s survey or full structural survey if you wish.

Or you can obtain your own independent property survey reports.

What do we advise? Our general advice is that you are best to allow the lender to satisfy their requirements with their valuation report. From there, you should get your own choice of surveyor to visit the house to conduct a further condition report for you.

Why get an independent survey?

As you know, buying a property will most likely be the biggest single purchase you will ever make in your life. You want to be as sure as you possibly can that the property you are buying doesn’t have any hidden surprises. Let’s face it, you don’t want to unearth problems down the line and end up paying far more than expected. A property survey can help bring to light signs of any problems with the property you hope to buy. Finding potential issues now can help save you a lot of money in the future.

Choice of Independent Surveys

The surveys you can get for yourself are usually categorised across three different levels. The difference between them comes down to variations in time, detail, and cost. But what is important is that you select the level of survey which is right for the property you hope to buy.

Level 1 – Condition Report. This gives a brief overview of the property. It is generally most suitable for new builds or apartments in shared developments. Such property surveys would usually only take around half an hour.

Level 2 – Home Buyers Report. This gives a more detailed inspection of the property to flag up any major concerns. It should take anything between 1-2 hours. This report is non-intrusive, meaning the surveyor won’t move furniture or lift floorboards. Instead they will identify concerns visible from a visual inspection.

Level 3 – Building Survey/ Full Structural Survey. This report is usually only commissioned on old properties, those of non-standard construction, or those in poor condition. Here, a surveyor can be at the house for several hours. While there, they will usually look in the loft and if possible, lift floor coverings. Such a report will outline all suspected concerns, advised maintenance and so forth on the property.

What happens after the survey?

Once your survey report is received, your surveyor may advise that further specialist inspections get carried out. These can include Electrical or gas inspections (by a qualified gas engineer or electrician); A Structural Report (from a structural engineer); Damp and Timber Report (specialist in damp issues); etc.

We can recommend local companies who conduct all the necessary inspections. We are also more than happy to offer advice on booking a survey. Or if you are unsure about your survey, we can help review the results and advise on expected costs.

Understanding the property

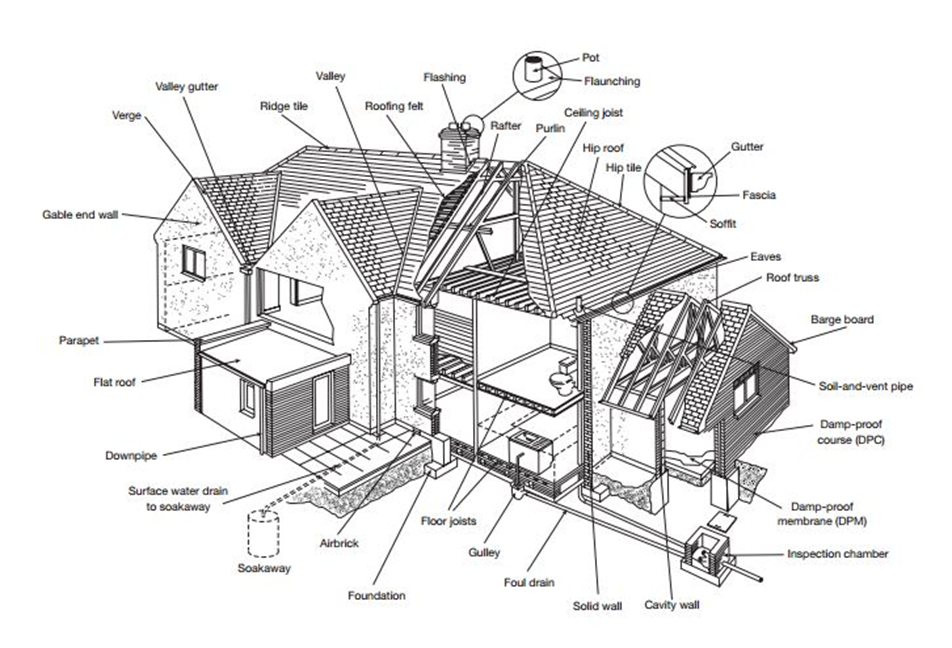

The level of information in a survey can sometimes be confusing; the surveyor may refer to property terms which you might have never heard of before. We can help you make sense of surveys and their terms, but at the same time, the diagram below is very useful to have to hand. It comes from the RICS guide to home surveys and helps to label all the different parts of a house. It might just help you understand and pinpoint areas on your survey report better.

And always remember, if you choose to buy a property without a survey, you are taking a big risk. For a little extra cost, you can find out exactly what state the property is in with a survey. And we highly recommend you get one!

Here at Jameson and Partners, we can help you with everything to do with buying, selling, or letting a property. Get independent, expert advice from our professional estate agents team in Altrincham.

Contact us today.